XRP Price Prediction: Technical Consolidation Meets Growing Institutional Demand - Is XRP a Good Investment?

#XRP

- Technical Consolidation: XRP is trading in a consolidation pattern below its 20-day moving average, with Bollinger Bands suggesting potential for a breakout

- Growing Institutional Adoption: New ETF filings, tokenized treasury products, and expanding payment network utility signal increasing institutional interest

- Mixed Market Sentiment: While whale accumulation and staking demand are positive, concerns about manipulation and short-term price pressure create a balanced risk-reward profile

XRP Price Prediction

XRP Technical Analysis: Consolidation Phase Signals Potential Breakout

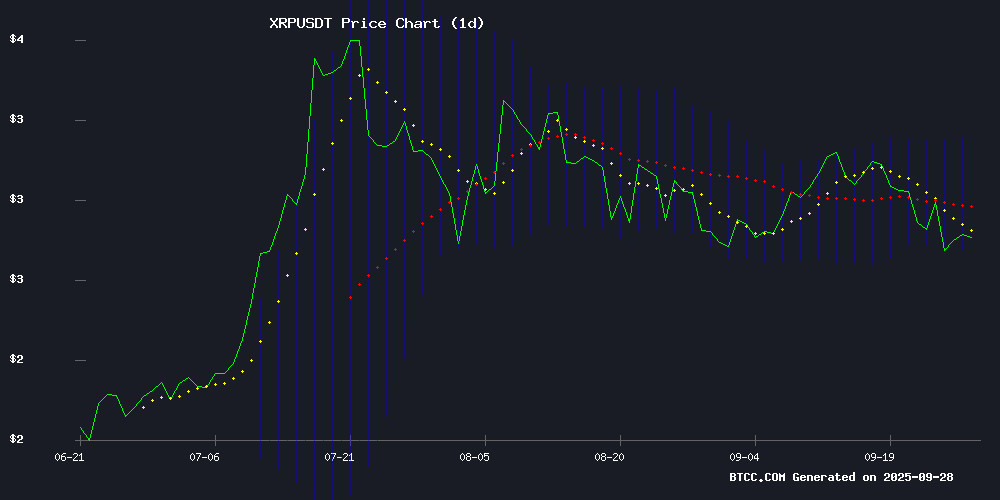

According to BTCC financial analyst Michael, XRP is currently trading at $2.7841, below its 20-day moving average of $2.9535, indicating short-term bearish pressure. However, the MACD reading of 0.0709 shows positive momentum building, while the Bollinger Bands position suggests the cryptocurrency is trading near the lower band at $2.7262, potentially signaling an oversold condition. Michael notes that this technical setup often precedes significant price movements, with the current consolidation potentially laying groundwork for a bullish reversal.

Mixed Market Sentiment as Institutional Interest Grows

BTCC financial analyst Michael observes that recent news FLOW presents a complex picture for XRP. While price consolidation and concerns about whale manipulation create near-term uncertainty, several positive developments suggest underlying strength. The emergence of Ripple's network as a SWIFT alternative, new ETF filings, and growing institutional adoption through products like tokenized U.S. Treasuries indicate fundamental improvements. Michael emphasizes that the $22M in XRP Vault staking and whale accumulation during this consolidation period could signal smart money positioning for future gains.

Factors Influencing XRP's Price

XRP Price: Analysts Debate Potential for 2017-Style Rally Repeat

XRP's market capitalization has sustained above its 2018 peak for an unprecedented 300 days, demonstrating remarkable resilience during recent market turbulence. Technical analyst Bobby A highlights a bullish flag pattern forming on charts, with two critical support levels—$1.9 and $2.89—successfully defended during volatility.

Price projections range from $5 to $13, which would establish new all-time highs for the digital asset. However, weekly charts show bearish divergence already triggering a 27% pullback from recent highs of $3.37. The current technical setup bears striking resemblance to 2017 patterns that preceded both exponential gains and subsequent 96% collapse.

Market observers note XRP's extended consolidation above previous resistance levels often precedes significant price movements. "Base Camp" support zones at $1.9 and $2.89 have become critical battlegrounds for bulls and bears alike. The cryptocurrency's ability to maintain these levels during broader market weakness suggests accumulating momentum.

XRP Price Decline and the Rise of Remittix in PayFi Sector

Ripple's XRP continues its downward trajectory, shedding its $3 psychological support level following the Federal Reserve's recent interest rate cut. The token now trades at $2.78, hovering precariously above critical support at $2.71. Market sentiment has turned bearish as investors unwind long positions, casting uncertainty over Ripple's near-term prospects.

Meanwhile, the PayFi sector sees a new contender emerging. Remittix, an upcoming project, is positioning itself to capitalize on XRP's weakness by offering innovative use cases for crypto traders. The platform aims to streamline cross-border transfers—a space where Ripple once dominated—though full details of its solution remain undisclosed.

XRP Whale Accumulation Surges Amid Price Consolidation

XRP is witnessing aggressive accumulation by large holders as prices stabilize near $2.95. Blockchain data reveals whales purchased 30 million tokens within 24 hours during the recent dip, signaling strong conviction in the asset's upside potential.

Analysts highlight $2.71 as a critical support level, with a sustained hold above this threshold potentially propelling XRP toward $3.60. The movement of over $812 million between anonymous wallets has further fueled market speculation.

Meanwhile, MAGACOIN FINANCE emerges as a rival altcoin gaining traction among traders seeking higher-risk, higher-reward opportunities this cycle. ETF rumors and institutional interest continue to underpin bullish sentiment for XRP.

New XRP ETF Filing Highlights Whale Manipulation Risks

A newly filed prospectus for the Cyber Hornet S&P500/XRP ETF has formally recognized whale manipulation as a material risk in the XRP market. The document submitted to the SEC notes that concentrated holdings among large XRP holders could significantly impact price stability.

Attorney Bill Morgan emphasized the significance of this institutional acknowledgment, contrasting it with crypto circles where such risks are often dismissed. The filing's inclusion in an SEC submission lends credibility to concerns about whale-driven volatility.

The prospectus also outlines XRP's unique structural characteristics. Unlike Bitcoin or Ethereum, XRP's entire supply was created at launch, with no mining or staking rewards to incentivize network participation. This fixed supply model presents distinct liquidity challenges that may exacerbate price movements.

Ripple's XRP-Powered Network Emerges as Superior Alternative to SWIFT in Global Payments

Ripple's On-Demand Liquidity platform, powered by XRP, is transforming cross-border settlements with near-instant transactions that eliminate the need for pre-funded accounts. This technological leap positions Ripple as a formidable challenger to SWIFT's decades-old financial messaging system.

While SWIFT experiments with blockchain through its ConsenSys partnership, these efforts focus solely on message enhancement rather than addressing core settlement finality or liquidity challenges. Ripple's solution already operates commercially across multiple jurisdictions, handling both liquidity and settlement in a unified system.

Market analysts observe that Ripple's comprehensive approach—using XRP as a bridge asset—achieves in seconds what traditional systems accomplish in days. The platform's growing adoption suggests a paradigm shift in global payments infrastructure, with SWIFT's dominance increasingly under threat.

Ripple and Ondo Finance Launch Tokenized U.S. Treasuries on XRPL

Ripple has partnered with Ondo Finance to tokenize U.S. Treasuries on the XRP Ledger, marking a significant step in institutional DeFi adoption. The collaboration introduces OUSG tokens, backed by Ripple's RLUSD stablecoin, enabling qualified investors to manage government debt securely on-chain.

This initiative positions XRPL as a competitive platform for real-world asset tokenization. By leveraging blockchain efficiency, the partnership bridges traditional finance with digital asset infrastructure, offering institutions streamlined access to Treasury instruments.

"Tokenization unlocks new liquidity pools while maintaining regulatory compliance," noted a Ripple representative. The OUSG tokens demonstrate how blockchain can transform legacy financial systems without disrupting existing frameworks.

mXRP Vault Surges Past $22M as Staking Demand Grows

The mXRP vault, a liquid staking solution developed by Midas in collaboration with Axelar and Interop Labs, has attracted over $22 million in deposits within days of launch. XRP holders can now earn up to 10% yield without exposure to rebasing or inflationary mechanisms common in traditional staking models.

Issued on the XRPL EVM sidechain, mXRP tokens maintain a 1:1 peg with XRP while accruing value through performance-based rewards. The tokens are interoperable with DeFi protocols, enabling additional yield generation opportunities. This rapid adoption underscores rising institutional interest in XRP's utility as a yield-bearing asset.

The launch coincides with expanding use cases for XRP, including stablecoin partnerships and tokenized fund initiatives. Market participants appear to be positioning for broader integration of XRP in structured financial products, with the mXRP vault serving as a bridge between traditional holdings and decentralized finance applications.

XRP Price: September Consolidation May Pave Way for October Rally

XRP hovers at $2.85 after a 4.3% weekly decline, testing critical support at $2.70. The Flare Network's FXRP v1.2 upgrade now enables DeFi participation for XRP holders, potentially increasing utility.

Technical indicators paint a conflicted picture. While the RSI at 58.8 suggests neutral momentum, a bearish MACD crossover tempers optimism. The $3.20 level looms as a decisive resistance point—a breakout could propel prices toward $3.50, while failure to hold $2.70 may trigger a retreat to $2.50.

Whale accumulation during dips and persistent ETF speculation underscore institutional interest. Market veterans note XRP's consolidation within the $2.50-$3.50 band reflects broader crypto market indecision ahead of Q4.

Will Institutional Demand Drive XRP Crypto Higher in 2025?

Ripple's XRP is gaining traction as institutional interest surges, fueled by strategic integrations and ETF growth. The RLUSD stablecoin's inclusion in BlackRock's BUIDL fund and VanEck's VBLL signals deepening ties between traditional finance and blockchain. Instant on-chain liquidity redemption positions RLUSD as a competitive force in real-world asset tokenization.

The REX-Osprey XRPR ETF has attracted $33.57 million in assets within days of launch, reflecting accelerating institutional adoption. This convergence of stablecoin utility and investment vehicle development could redefine XRP's market trajectory through 2025.

Black Swan Capitalist Proposes XRP as Solution to Global Debt Crisis

Global sovereign debt has surged past $315 trillion as of September 2025, with the U.S. alone accounting for $36.2 trillion—over 122% of its GDP. Versan Aljarrah, founder of Black Swan Capitalist, argues that traditional systems are ill-equipped to handle this unsustainable burden. The solution, he suggests, lies in blockchain-based restructuring.

Tokenization is emerging as a viable pathway. The market for tokenized assets grew 85% year-on-year to reach $15.2 billion in 2025. Analysts from the World Economic Forum and Boston Consulting Group project this could expand to $10–16 trillion by 2030. Aljarrah identifies XRP, tokenized gold, and regulated stablecoins as neutral assets capable of anchoring a new financial architecture.

"The real play isn't repayment—it's transforming debt into liquid, blockchain-based instruments," Aljarrah states. XRP's efficiency in cross-border settlements positions it as a potential linchpin for this systemic reset.

Top U.S. Exchange to Introduce Yield Earning Feature for XRP

A leading U.S.-based cryptocurrency exchange has revealed plans to launch a yield-earning feature for XRP, addressing one of the most sought-after demands from the digital asset's holders. The development coincides with the Flare network's rollout of its FAssets protocol, which is set to expand XRP's utility in decentralized finance (DeFi) ecosystems.

Market participants view this as a strategic move to capitalize on XRP's growing prominence in DeFi, particularly as institutional interest in blockchain-based financial solutions intensifies. The timing aligns with broader industry trends where exchanges are increasingly offering passive income products to retain users amid competitive yield-generating alternatives.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment case with measured risk. The cryptocurrency is trading at $2.7841, showing consolidation below its 20-day moving average, which often precedes significant price movements. Technical indicators suggest potential for upward movement, with the MACD showing positive momentum and Bollinger Bands indicating possible oversold conditions.

| Metric | Current Value | Interpretation |

|---|---|---|

| Price | $2.7841 | Below 20-day MA, consolidation phase |

| 20-day MA | $2.9535 | Resistance level to watch |

| MACD | 0.0709 | Positive momentum building |

| Bollinger Lower Band | $2.7262 | Potential support level |

Fundamentally, the growing institutional adoption, including new ETF filings and Ripple's expanding payment network utility, provides strong long-term prospects. However, investors should be aware of whale manipulation risks and monitor key technical levels for entry points.